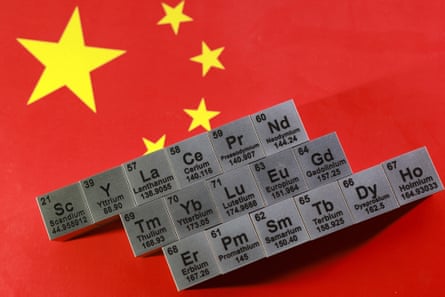

The EU is struggling to wean itself off its dependence on China and countries in the Global South for key minerals and rare earths needed for everything from smartphones to wind turbines and military jets.

A damning report by the European Court of Auditors (ECA) in Luxembourg found that the bloc’s targets for 2030 are “out of reach” due to a lack of progress in domestic production, refining and recycling.

“It is therefore vital that the EU raises its game and reduces its vulnerability in this area,” said Keith Pentus-Rossimannus, the ECA member responsible for the audit.

The report, which examined the EU’s ability to meet its target of 42.5% of energy from renewables in 2030, revealed a chasm between rhetoric and reality.

One of the most damning conclusions is that mining and exploration in the EU is not only “developing” but that “even if new deposits are discovered, it could take 20 years for the EU mining project to come into force”.

“This makes it difficult to envisage any concrete contribution by the 2030 deadline,” the report said.

It comes as UK Prime Minister Keir Starmer agreed to step up cooperation with Japan on key minerals during talks with his rival Sane Takaichi in Tokyo on Saturday.

US Secretary of State Marco Rubio met A summit of about 20 nations in Washington Wednesday to coordinate the diversification of mineral supplies, including lithium, nickel, cobalt, copper and rare earth elements needed for solar panels, wind turbines and car batteries.

The summit is seen as a step to mend transatlantic ties that have been fractured by a year of rifts with Donald Trump and pave the way for other alliances to help countries mitigate the threat from China.

A map of suppliers shows dependence on the East, Especially China And Russia supplies 29% of the nickel used in the auto and aerospace sectors.

The EU is highly dependent on China, importing seven of the 26 minerals studied: 97% of magnesium, which is used in hydrogen production; 71% of gallium, used in smartphones and satellite communications; and 31% tungsten, used in drilling and mining.

On rare earths, China controls between 69% and 74% of the six most important rare earths, including neodymium and prasodymium, two minerals needed to make permanent magnets used in everything from car locking systems to fridge doors and wind turbines.

Brussels has previously revealed that 17,000 tonnes of the 20,000 tonnes of permanent magnets used by EU industry in 2024 will come from China.

Lithium, needed for car batteries, comes mostly from Chile, but Turkey supplies 99% of boron, which is used in solar panels, the ECA found.

“Many strategic projects will struggle to secure supplies of their critical raw materials by 2030,” the ECA said, adding that “the EU could become trapped in a vicious circle.”

“Without critical raw materials, there will be no energy transition, no competitiveness and no strategic autonomy. Unfortunately, we are now dangerously dependent on some countries outside the EU for the supply of these materials,” Pentus-Rossimannus said.

The report comes as EU Industry Commissioner Stéphane Séjourné stated that unless Europe develops an “ambitious, efficient and practical industrial policy” it will “remain a mere playground for its competitors”.

The ECA concluded that “efforts to diversify imports have not yet yielded tangible results”, noting that partnerships with seven countries with poor governance have led to a decrease in supplies between 2020 and 2024 rather than an increase.

Of the 26 major critical minerals, 10 are fully imported, while none of the 17 rare earth metals are mined in the bloc. Recycling also lags behind: only 16 critical raw materials are recycled in the block.