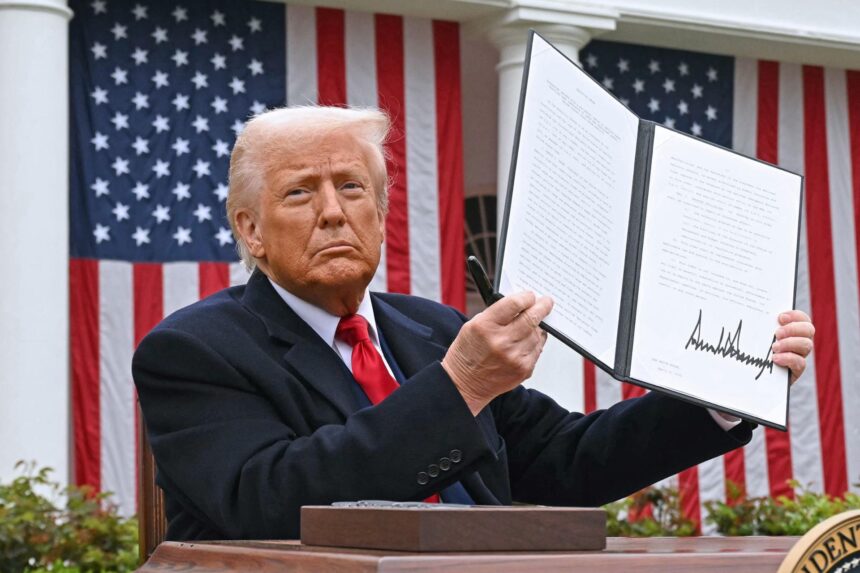

US President Donald Trump holds up an executive order signed after making remarks about “reciprocal” tariffs during a Rose Garden event titled “Make America Rich Again” at the White House in Washington, DC on April 2, 2025. The US Supreme Court ruled on Friday that Trump exceeded his authority in imposing a set of tariffs that upended global trade, crippling a key tool the president has used to impose his economic agenda. AFP-Yonhap

WASHINGTON — The U.S. Supreme Court ruled Friday that President Donald Trump exceeded his authority by exploiting his emergency economic powers to impose tariffs — a rare rebuke that deals a major blow to his economic agenda.

What are the ramifications of the conservative-majority court’s decision, and is it possible for the Trump administration to reimpose the tariffs?

Low customs duties at the moment

The average US tariff rate will likely decline – at least temporarily – with some duties imposed under the International Emergency Economic Powers Act (IEEPA) deemed illegal.

“Without IEEPA tariffs, consumers would face an overall average effective tariff rate of 9.1 percent, which would remain the highest since 1946 excluding 2025,” the Yale Budget Lab said.

Had the IEEPA definitions remained in place, this figure would have been 16.9% instead.

Analysts say that even if the Trump administration replaces the canceled tariffs, the new levels will likely be lower than before.

“This will result in a reset of tariff policy that will likely result in lower overall tariff rates and more orderly imposition of future tariffs,” said Heather Long, chief economist at Maritime Federal Credit Union.

“Tariffs appear to have dented Trump’s popularity, and frustration with high prices remains a hot political topic in the US ahead of the midterm elections in November,” added Oliver Allen of Pantheon Macroeconomics.

Revenue setback

Economists also expect a setback to US government revenues, with some estimating that IEEPA-related tariffs generate between $130 billion and $140 billion by the end of 2025.

“However, the question of whether the funds can be recovered remains open at the moment and will be decided by lower courts in the coming months,” ING analysts Carsten Brzeski and Julian Gibb said.

“Refunds will not come automatically,” ING analysts added, and importers will have to file a lawsuit to get their money back.

“This process has already begun, with more than 1,000 corporate entities now involved in the legal battle,” they said.

If the government is on the hook to recover tariffs, it could result in another financial hit.

loss of “flexibility”

US Treasury Secretary Scott Besent warned earlier that the biggest concern is that the president may lose his “flexibility in using tariffs” for reasons of national security and leverage in negotiations.

But he emphasized that the Trump administration is still able to continue using tariffs as a source of revenue.

Eliminating tariffs under emergency powers “would limit the president’s ambitions to impose sweeping tariffs on a whim,” said Erica York, vice president of federal tax policy at the Tax Foundation.

But Wendy Cutler, vice president of the Asia Community Policy Institute, said U.S. partners are unlikely to abandon recently concluded tariff agreements.

She added: “They know very well that such a move could ultimately leave them in a worse position with the White House.”

Plan B

Trump has other ways to reimpose tariffs, and analysts expect him to do so.

Section 122 of the Trade Act of 1974 allows the president to address balance of payments issues by imposing temporary import tariffs of up to 15 percent.

The US President can also impose additional duties of up to 50% on countries that engage in discriminatory trade practices under Section 338 of the Tariff Act of 1930.

Other tried-and-tested approaches include Section 232 of the Trade Expansion Act of 1962, which Trump has already repeatedly exploited to impose tariffs on specific sectors not affected by Friday’s ruling.

Likewise, Section 301 of the 1974 Trade Act, which Trump used to target Chinese imports during his first presidency, remains at his disposal. Like Section 232, this requires an investigation period.

In January, Trump told the New York Times that he could also recast his tariffs as licensing fees.