US President Donald Trump moved quickly on Friday to replace tariffs struck down by the country’s Supreme Court with a temporary 10 percent global import tariff for 150 days.

Trump’s new executive order came just hours later The nine-judge Supreme Court panel, in a split 6-3 ruling, ruled that the tariffs imposed by his administration under the International Emergency Economic Powers Act of 1977 amounted to an abuse of authority.

Trump China signed executive orders late Friday to impose new tariffs starting Tuesday under Section 122 of the Trade Act of 1974, partially replacing tariffs ranging from 10 percent to 50 percent under IEEPA. He also ordered new investigations under other laws that might allow him to reimpose tariffs.

While this tariff has been imposed on all countries, including India, it still offers some exemptions.

Exemptions from Donald Trump’s new tariffs

Donald Trump’s executive orders for new 10 percent tariffs continued exemptions already in place for a range of products.

These include space products. Passenger cars and some light trucks; Goods from Mexico and Canada that comply with the United States-Mexico-Canada Trade Agreement; Pharmaceuticals. And some important minerals and agricultural products.

According to a White House fact sheet, some goods will not be subject to tariffs due to the needs of the US economy or to ensure that tariffs more effectively address “fundamental international payments problems.” Some important metals and minerals used in coins, bullion, energy and energy products fall into this category.

The fact sheet further explained that natural resources and fertilizers that cannot be grown, extracted, or otherwise produced in the United States, or that are not produced in sufficient quantities to meet domestic demand, are also exempt.

Many agricultural products, including beef, tomatoes, and oranges, are exempt, as are medicines, pharmaceutical ingredients, and some electronic devices.

Taxes will also not be imposed on passenger vehicles, some light trucks, some medium and heavy vehicles, buses, certain parts of passenger vehicles, and some aerospace products.

The same applies to books, donations and accompanying belongings.

Justification for a 10 percent tariff

Section 122 of the Trade Act of 1974, which was never used, allows the US president to impose tariffs of up to 15% for up to 150 days on any country to address “substantial and serious” balance of payments issues. It does not require investigations or other procedural limits. After 150 days, Congress will need to approve the extension.

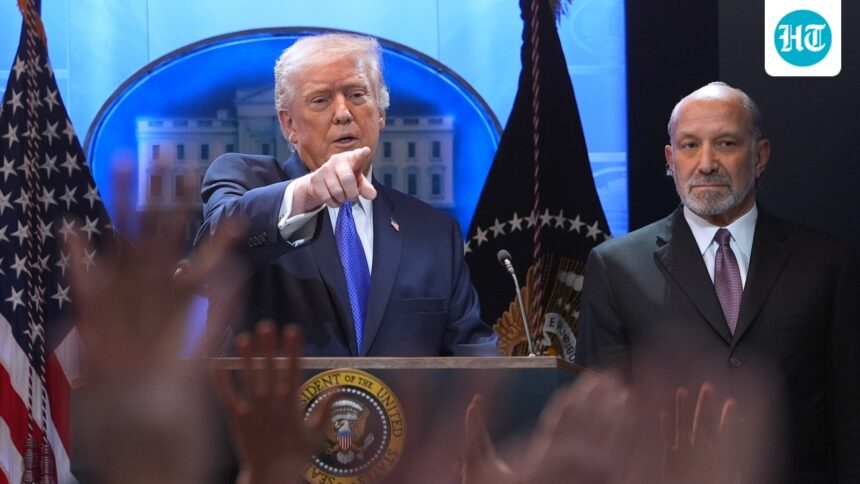

“We have alternatives, great alternatives,” Trump said of alternative tools after the Supreme Court ruling. “There could be more money. We’ll have more money, and we’ll be much stronger for it.”

The 10% tariff order justified the use of Section 122, stating that the United States had a “large and dangerous balance of payments deficit” and that the situation was getting worse.

While the administration is likely to face legal challenges, the Section 122 definitions will likely expire before any final ruling is issued.