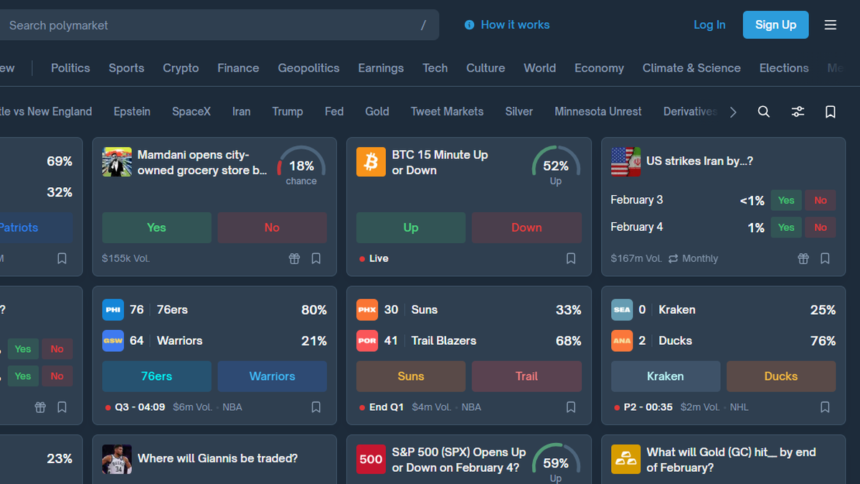

In the booming segment of the Internet, gamblers no longer limit their bets to sports teams and horses. They also bet on the likelihood of an Israeli attack on Gaza, the outcome of the US election, the likelihood of Jesus Christ coming, and the number of tweets Elon Musk gives.

These bets are placed on prediction market platforms such as Kalshi and Polymarket, where speculators bet on the outcome of real-world events, including wars, the Oscars, ongoing court cases, gold prices, government activities and local weather.

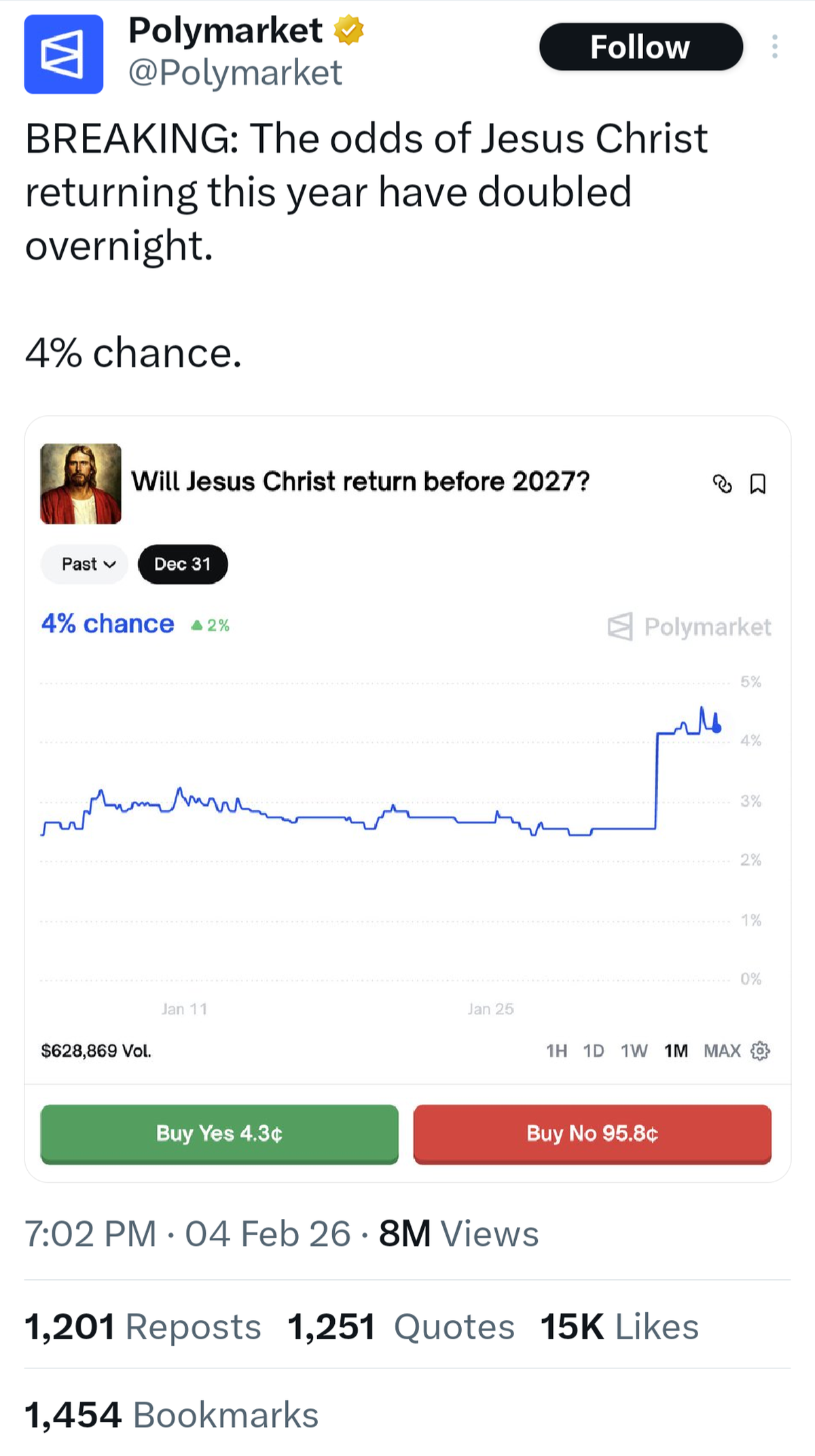

Polymarket users are betting on the return of Jesus Christ | Photo credit: Polymarket on X

How do prediction markets work?

A prediction market is a platform where users buy units of a ‘potential event’ to profit when that event occurs (or does not occur). Typically, users can fund their trading accounts with crypto, credit/debit cards or bank transfers. A platform fee may or may not be charged. Once set up, users can browse topics like science, sports, culture, finance, etc. to find the event they want to bet on.

Both Kalshi and Polymarket claim to be the largest prediction market platforms. For transactions, Polymarket uses USDC stablecoin—an official cryptocurrency with a US dollar value—through the Polygon network.

Take the real question from Polymarket as of February 4: “Will anyone be jailed for Epstein disclosures?” Here, a ‘yes’ answer was then worth 19 cents, while a ‘no’ was worth 82 cents. Clearly, consumers are betting on the end result. Users choose ‘yes’ or ‘no’ to buy “shares” and these values may change based on new developments. A Polymarket calculator shows that buying $100 worth of ‘yes’ shares would mean the user would get $499.43 if anyone were jailed as a result of the Epstein revelations. If they bought $100 worth of ‘no’ shares, they would get $121.95 if the situation failed as they expected. Keep in mind that “unit” prices can change drastically at any time. Users can choose to sell their “shares” before the specified maturity, whether they want to cash in their profits or cut losses.

Prediction markets are gaining popularity due to their design, convenience and social media virality. Kalshi and Polymarket give speculators the confidence to bet on real-world events they know, instead forcing them to research unfamiliar asset classes or learn about technical investment options and indicators.

Zooming out, prediction markets claim that such economies focus on crowdsourced truth or crowd wisdom and are less prone to bias and fraud because large numbers of people bet on outcomes they truly believe in.

Regarding the controversial Middle East-related prediction markets that allow bets on future airstrikes, the Polymarket website states: “After talking with those directly affected by the attacks, who have dozens of questions, we realized that prediction markets can give them answers in ways that TV news and 𝕏 can’t”.

Kalshi says his users “have the ability to make the same smart trades and strategic investments that were once the exclusive domain of the financial community.”

Why are prediction markets criticized?

Opponents of prediction market platforms list risks such as encouraging irresponsible gambling, encouraging people to bet on violence, the rapid spread of false news, and the potential for insider trading as powerful people participate in sensitive markets.

In January 2025, Kalshi announced that Donald Trump Jr. had joined as a strategic adviser. Mr. Trump said his close associates used the kalshi on election night to find out Trump had won “hours before the fake news media.” Trump Jr. said in X. In August, media outlets reported that Trump Jr.-linked venture capital firm 1789 Capital had invested in PolyMarket and that he had joined its advisory board.

Both Kalshi and PolyMarket are active on social media platforms such as Elon Musk-owned X and Meta-owned Instagram, where they post clickbait-style news snippets to their massive followings and their Vina. User bets are portrayed as fact-based statistics.

Moreover, both Polymarket and Kalshi have published fake news in the past. In fact, Amazon’s Jeff Bezos once disputed Polymarket’s claim that he urged Gen Z entrepreneurs to get “real-world jobs” at McDonald’s or Palantir before starting a business. Meanwhile, the Axios The outlet reported that Kalshi’s false post about US and Denmark talks led to an official clarification from Denmark.

Are prediction markets regulated?

This is a gray area. Prediction markets are regulated in some jurisdictions and prohibited in others. Kalshi reports that it is regulated by the US Commodity Futures Trading Commission (CFTC), but it faces restrictions and legal challenges in multiple US states. Meanwhile, 33 countries, including the US, Germany, the UK and Singapore, are completely restricted from accessing Polymarket.

Prediction markets are also attracting interest in India. In recent months, multiple Reddit users have created threads asking whether betting through platforms like Polymarket is legal in India. Other Redditors have explored ways to make money from prediction markets without attracting legal scrutiny.