If trust has been Nirmala Sitharaman’s byword for taxpayers so far, she has gone further this year to improve the “ease” of filing and updating returns, and encourage voluntary compliance to reduce lawsuits. The new Income Tax Act, 2025, which comes into effect from April 1, is revenue neutral, with no changes in income tax rates or slabs, but reduces the number of sections by almost half and removes layers of interpretive ambiguity, Sitharaman said. One of the most important changes is the introduction of a single “tax year”, replacing the confusing distinction between an assessment year and the previous year.

Union Budget 2026 bets big on rare earth, chips, orange economy: Nirmala Sitharaman’s full speech

Redesigned income tax return forms will be notified soon, with the government promising simpler language and layouts that will allow ordinary taxpayers to comply without professional help.

The Foreign Minister said the time limit for filing a revised tax return has been extended from nine months to 12 months after the end of the tax year, leaving enough scope to fix errors without staring at a penalty. Taxpayers can now update their returns after initiating reassessment proceedings at a cost. An additional tax rate of 10% will apply in addition to the rate applicable in the relevant year. These returns may also be filed to reduce previously claimed losses.

More time to review and fix errors

CA Ketan Vajani said, “Taxpayers can now take shelter under the updated return and avoid penalties at an additional cost of 10%. An amendment is proposed from assessment year 2026-27 and the benefit can be availed even in the current financial year.” “Instead of paying 25%, the taxpayer would have to pay 35%,” added Gautam Nayak, tax partner at CNK & Associates. “However, this would enable the matter to be closed without resorting to a lengthy and time-consuming reassessment process and subsequent sanctioning process.”

Naturally, such updated declaration cannot be submitted in prohibited cases, such as those where information is available under the Black Money Act, Prevention of Money Laundering Act, etc.

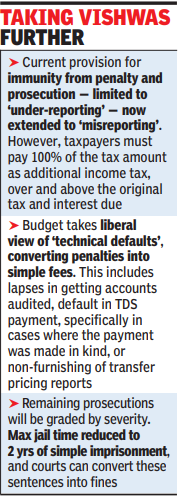

” Currently, having an additional Rs 8 lakh, she can now do this. In a further step to reduce conflicts, the Foreign Minister proposed merging assessment and sanctions procedures into one common system. By reducing paperwork and the potential for physical interactions with tax officials, applications for low/zero TDS certificates can be submitted electronically. The tax starts from 25% and reaches 70% of the differential tax and interest due depending on the delay in submitting the updated return. Furthermore, it is now possible to file an updated return to reduce previously claimed losses. For example, if the original return had a loss of Rs 10 lakh and the taxpayer wants to file an updated return with a loss of Rs 8 lakh, she can now do so. In a further step to reduce conflicts, the Foreign Minister proposed merging assessment and sanctions procedures into one common system.

By reducing paperwork and the potential for physical interactions with tax officials, applications for low/zero TDS certificates can be submitted electronically.